Supplier Onboarding: Local Vendors and W9 Uploads (GFR)

Below is more information about specific onboarding tasks related to store-level local suppliers, including W9 form uploads. This process allows Walmart associates to collect forms and validate supplier information.

Do You Have a Retail Link Account?

- If you have already registered, log in at https://walmart.com/w9 and skip to the Provide Your Tax ID and Document instructions below to access the W9 application.

- If you have not registered yet, follow the instructions in all sections below – starting with Create Your Retail Link Account.

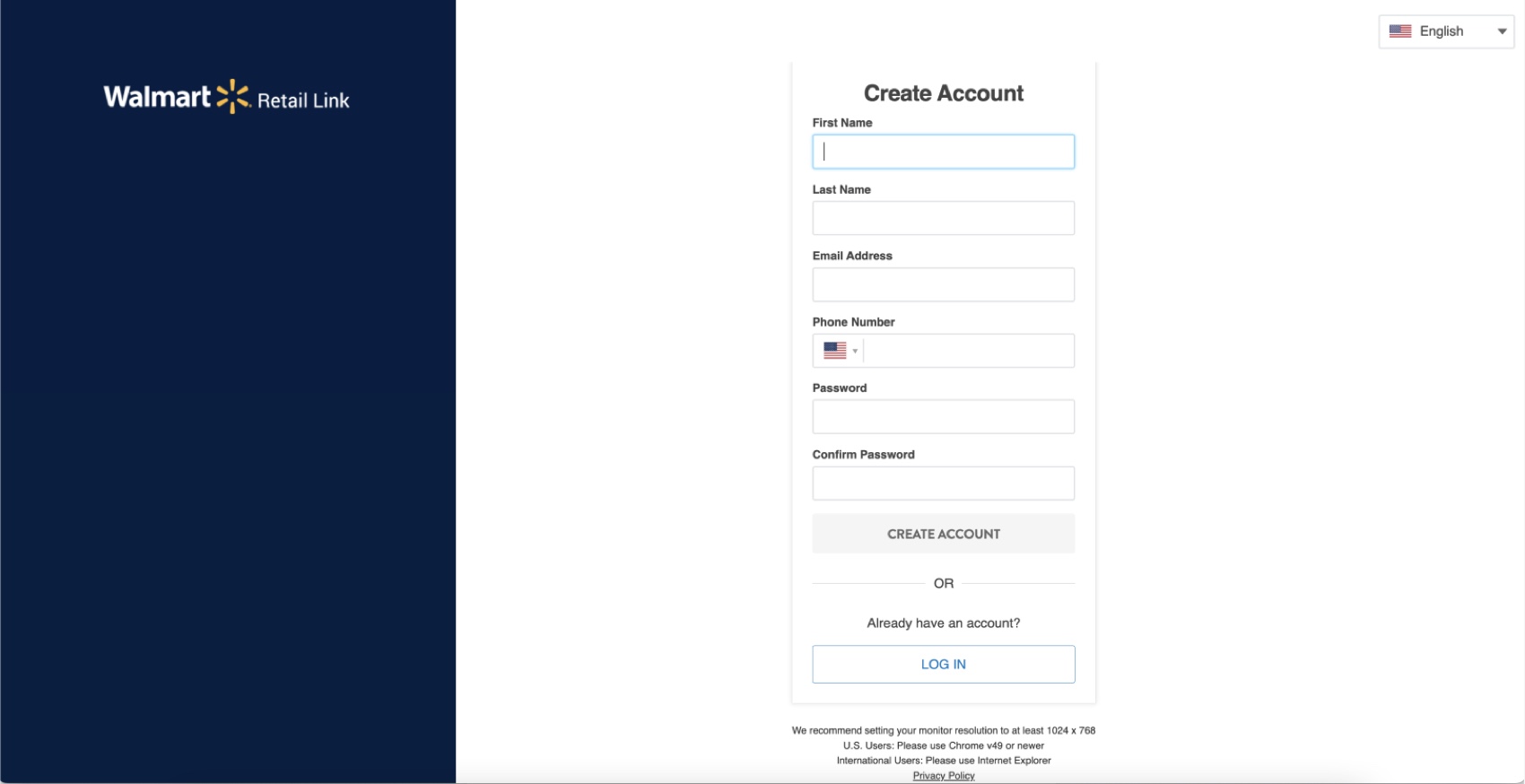

Create Your Retail Link Account

- Go to https://walmart.com/w9. This takes you to the Retail Link self-registration page to create your supplier account.

- Complete the fields shown below and click Create Account.

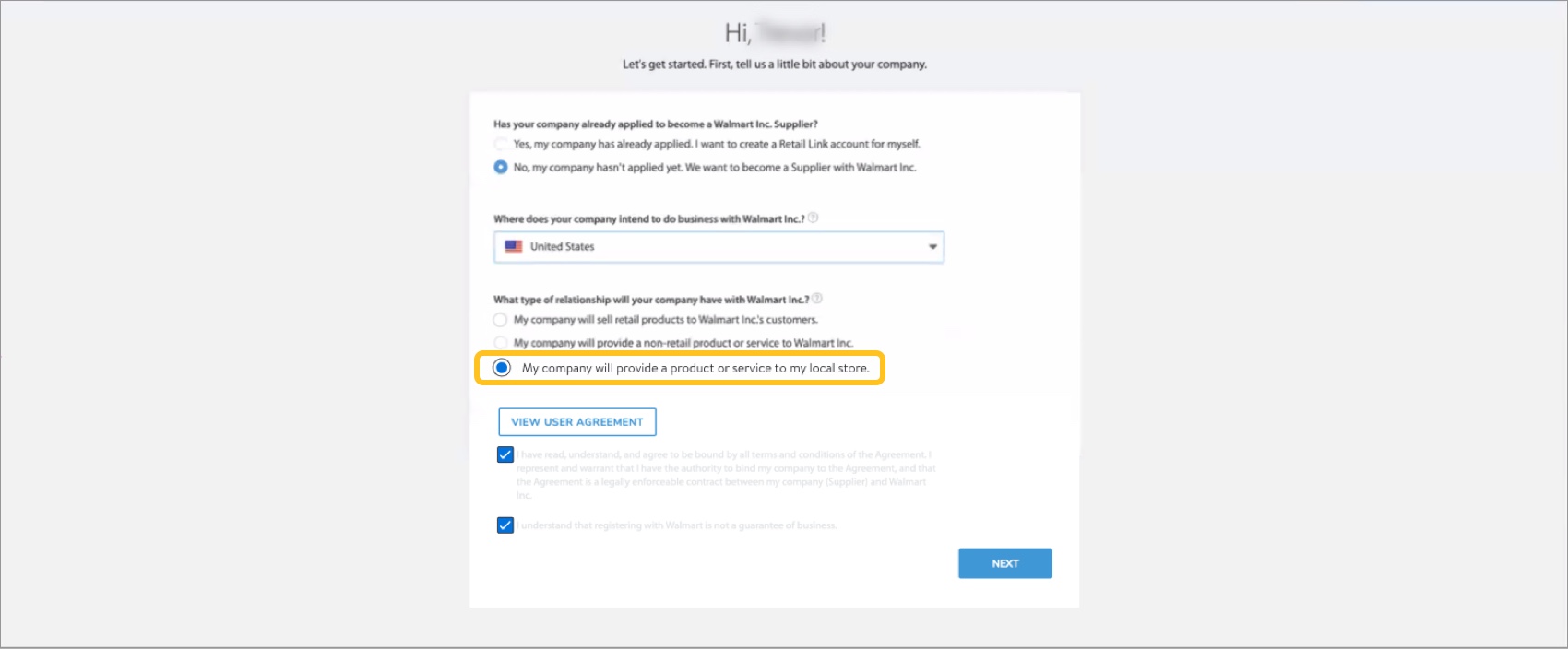

- During registration and account creation, indicate that you are a Local Supplier (i.e., you or your company will provide a product or service to your local store). Local Suppliers are not required to provide a DUNS Number or Supplier Number.

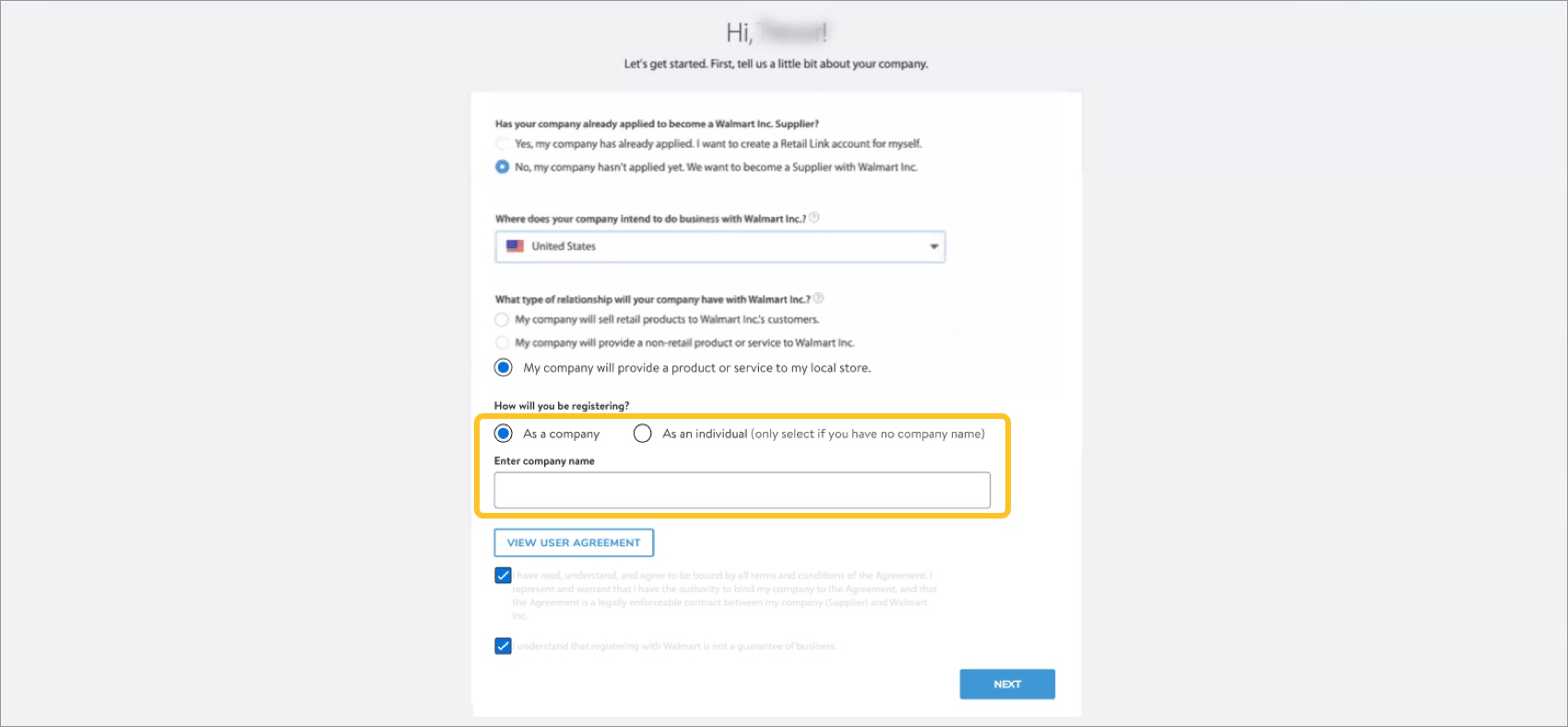

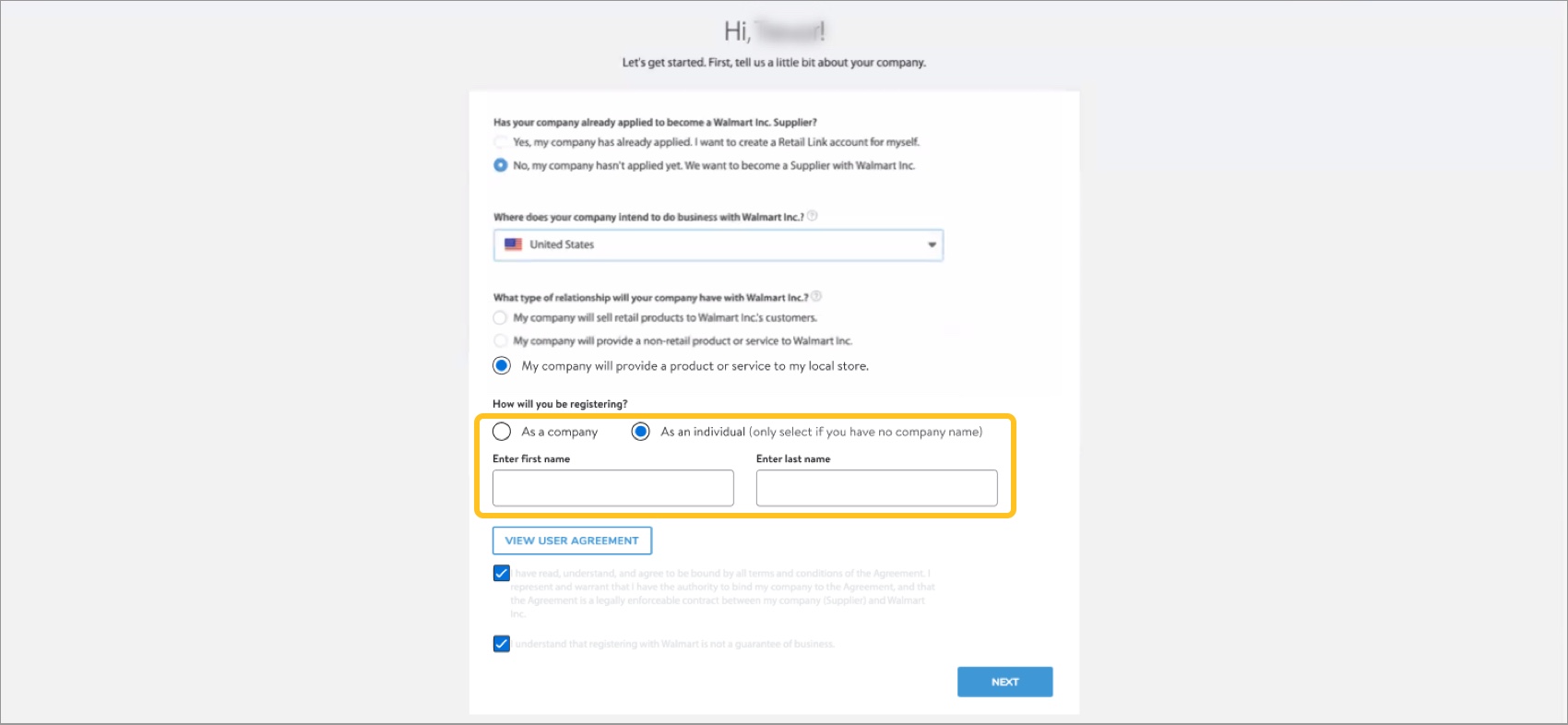

- Indicate if you are registering the account as a company (i.e., entity) or as an individual (i.e., if you have no company name).

- If registering as a company, you must provide the company name.

- If registering as an individual, you must provide your first name and last name.

- If registering as a company, you must provide the company name.

- During registration and account creation, indicate that you are a Local Supplier (i.e., you or your company will provide a product or service to your local store). Local Suppliers are not required to provide a DUNS Number or Supplier Number.

Verify Your Email and Business

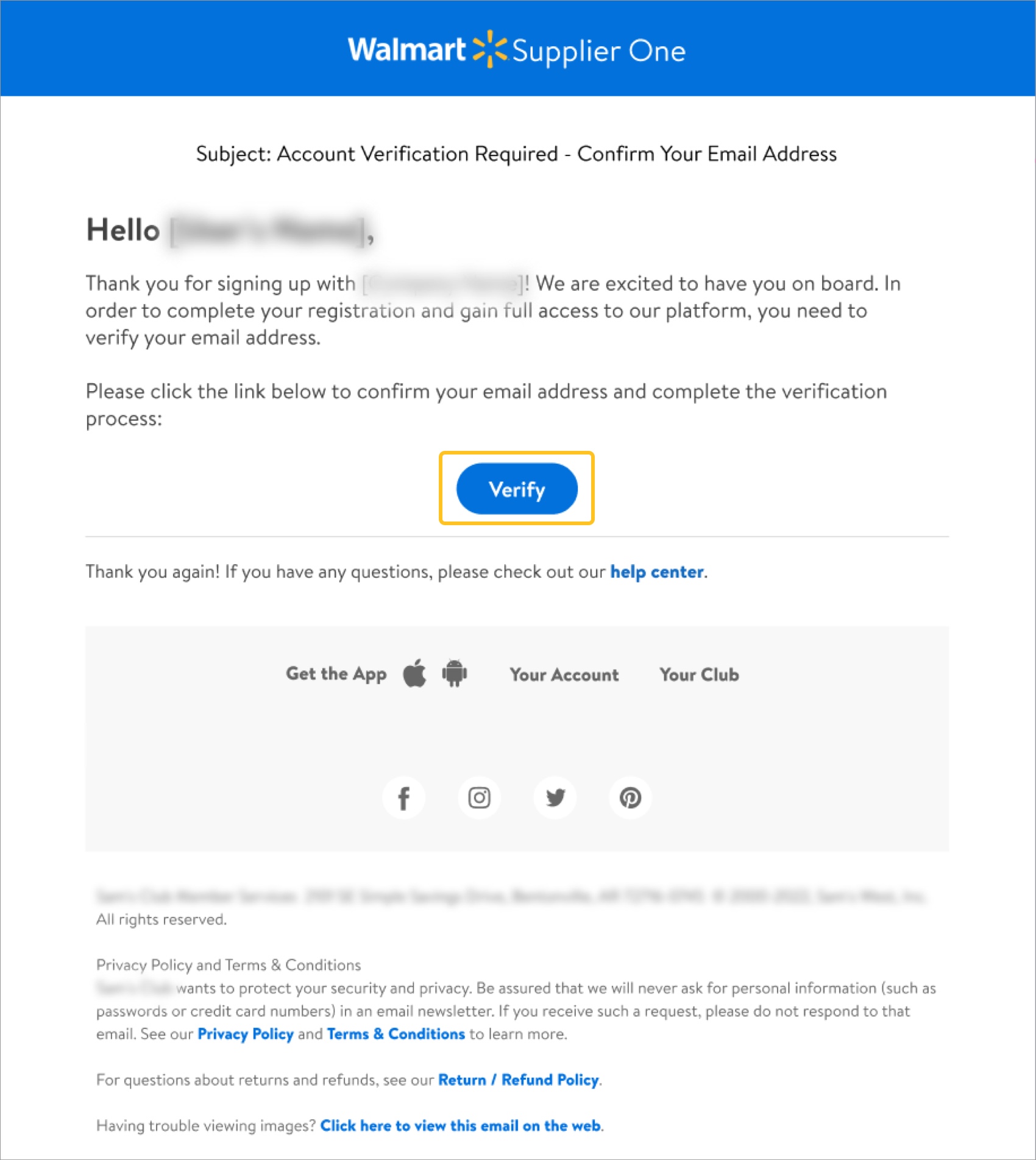

- Once you have created your Retail Link account, you will receive an email. Click Verify.

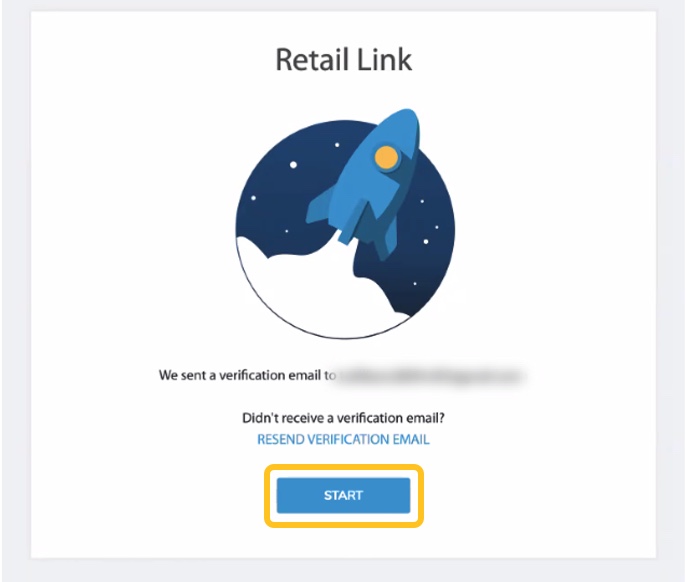

- Click Start.

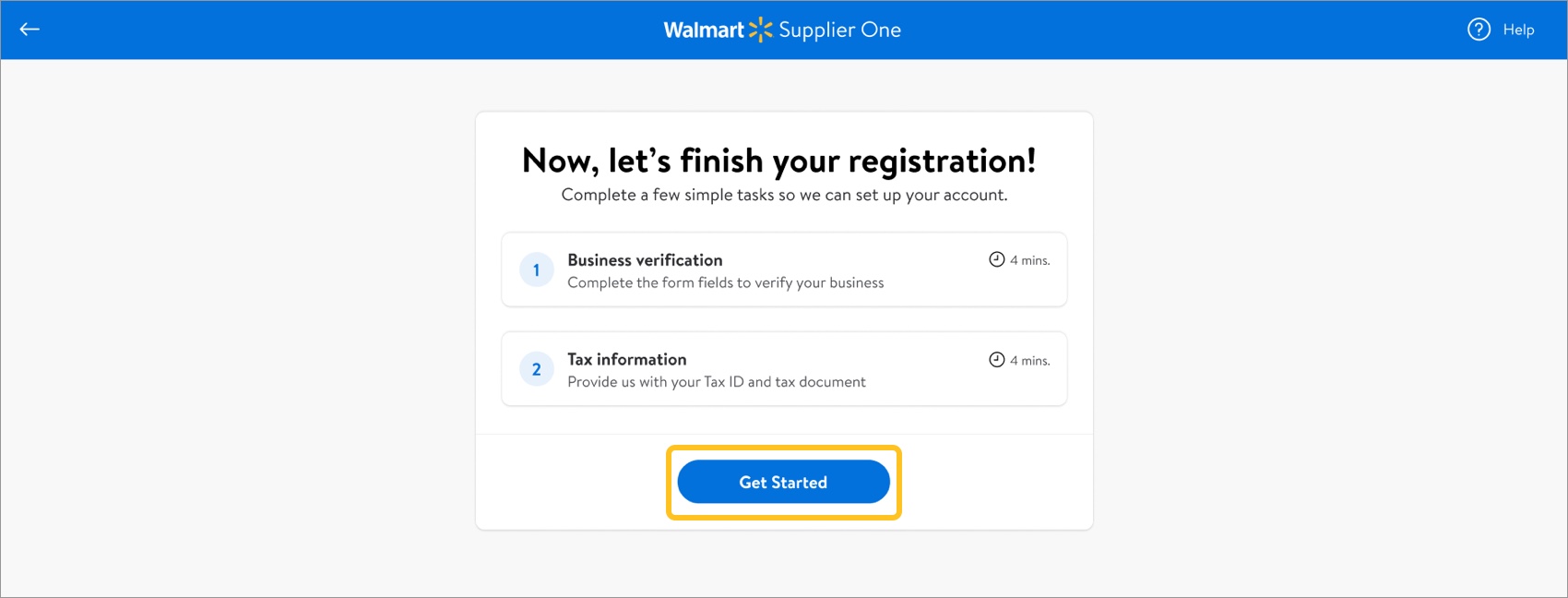

- Click Get started to finish your registration.

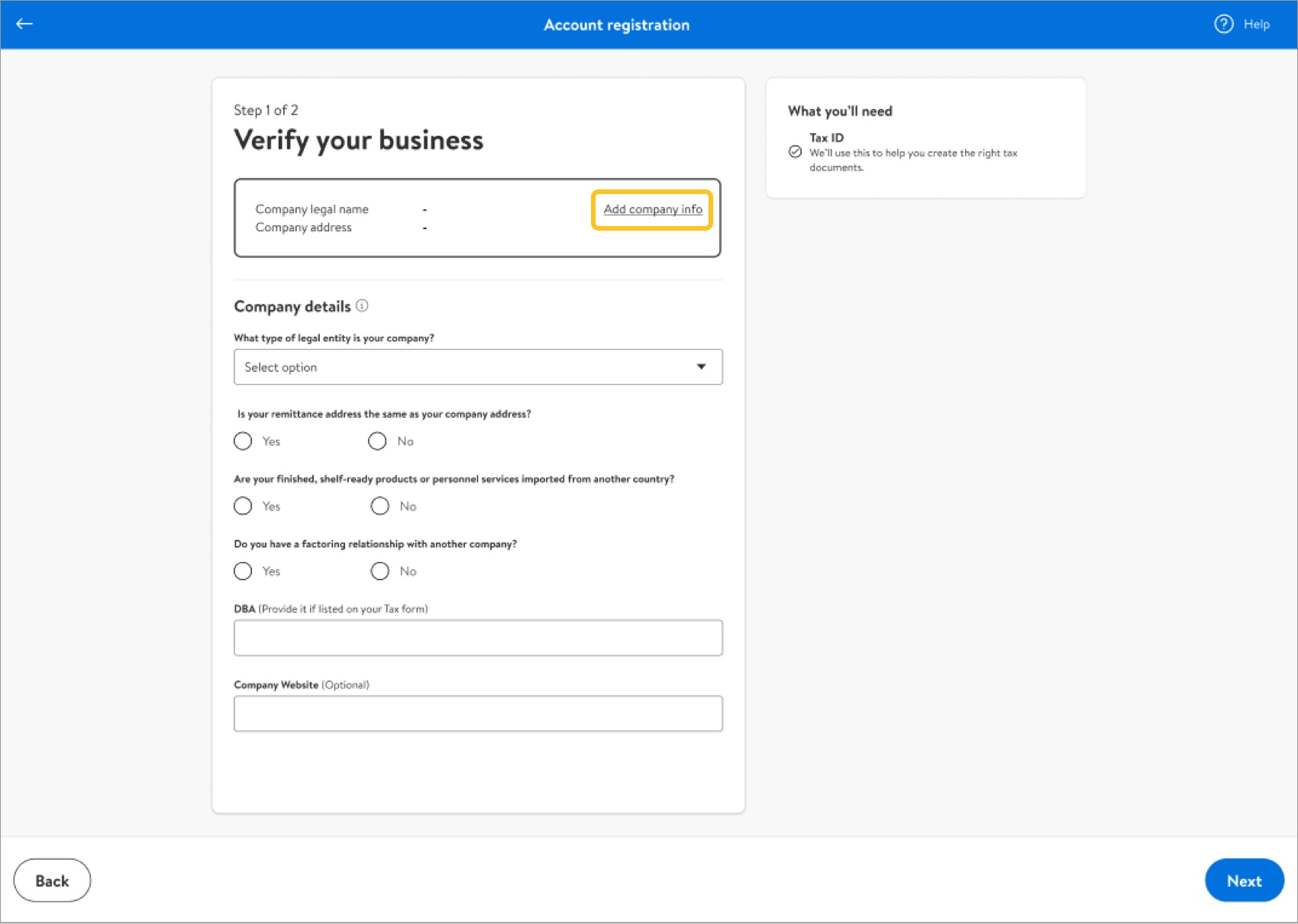

- Click Add company info to search for, select, and submit your company name and address.

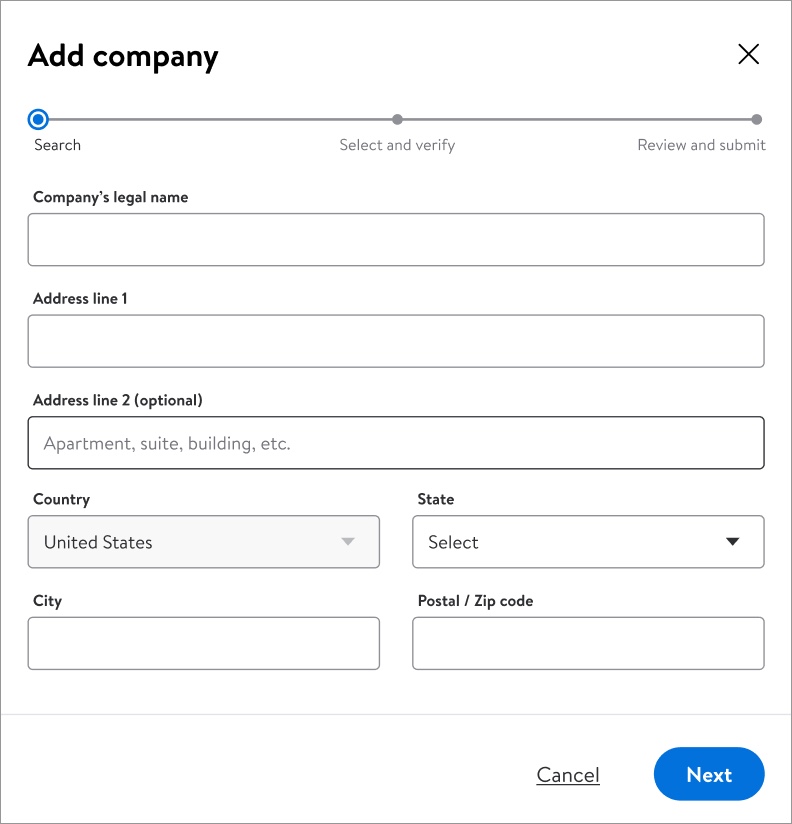

- Provide your company's legal name and address. Then, click Next.

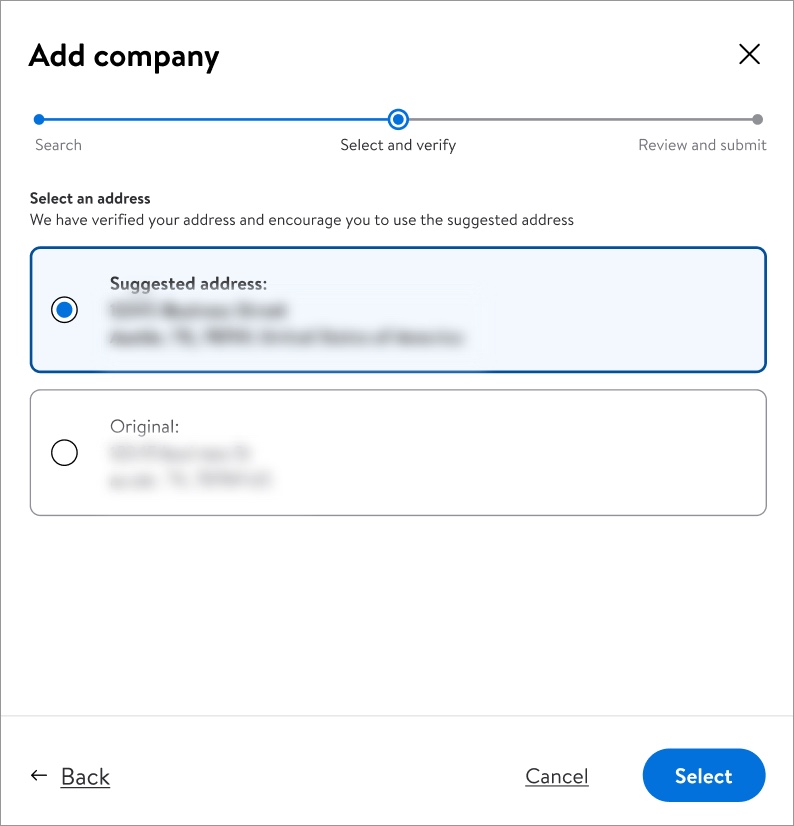

- Review the suggested address. If it is correct, select it and click Select.You can select the original address you provided if the suggested address is incorrect.

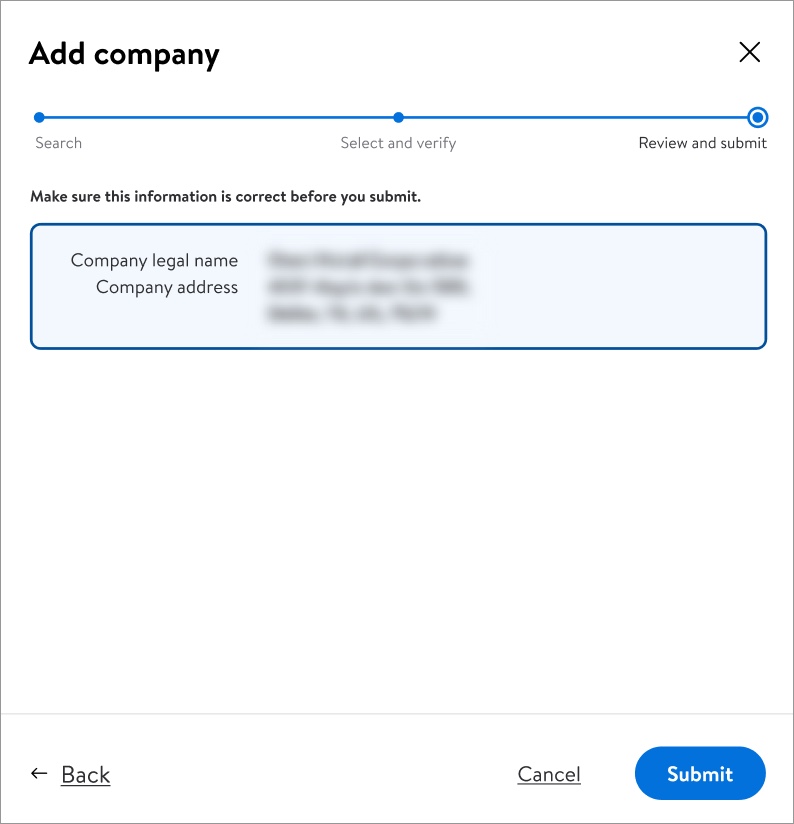

- Review your company's legal name and address. If they are correct, click Submit.If they are incorrect, click Back to try your search and select again.

- Provide your company's legal name and address. Then, click Next.

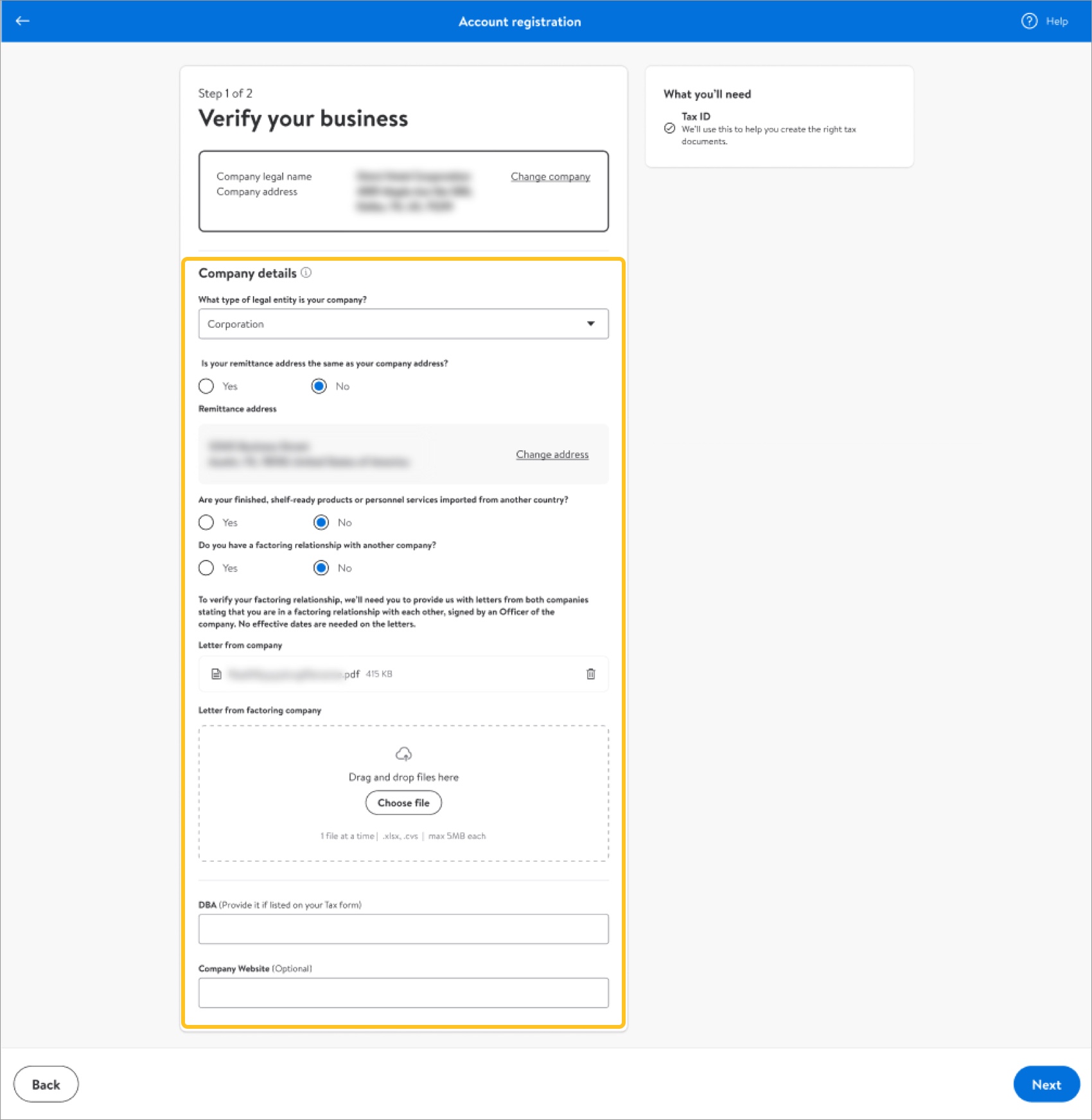

- Provide your company details. Then, click Next.The options for What type of legal entity is your company? are Sole proprietorship, Corporation, or LLC/partnership.

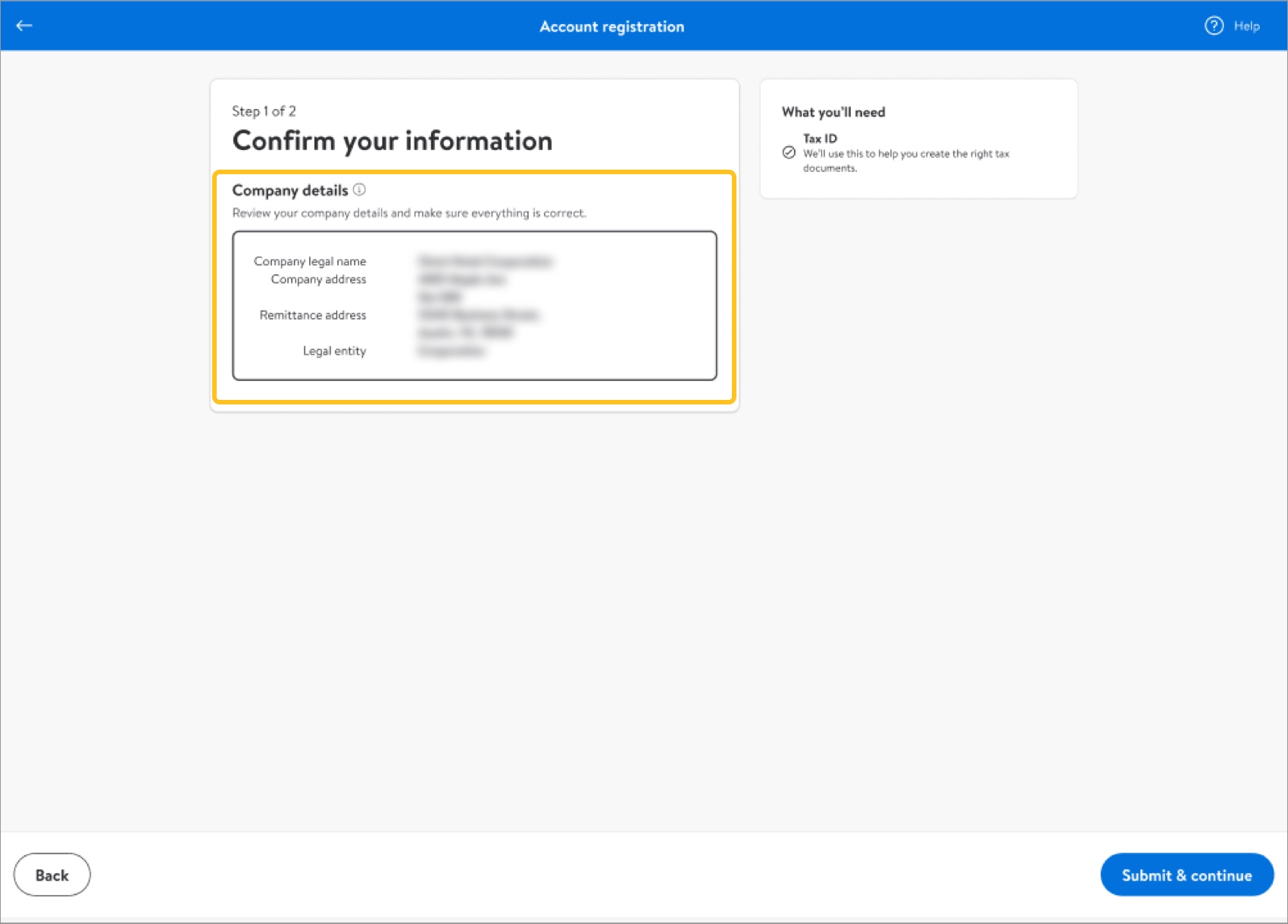

- Review your company details. If they are correct, click Submit & continue.If they are incorrect, click Back to make edits.

Provide Your Tax ID and Document

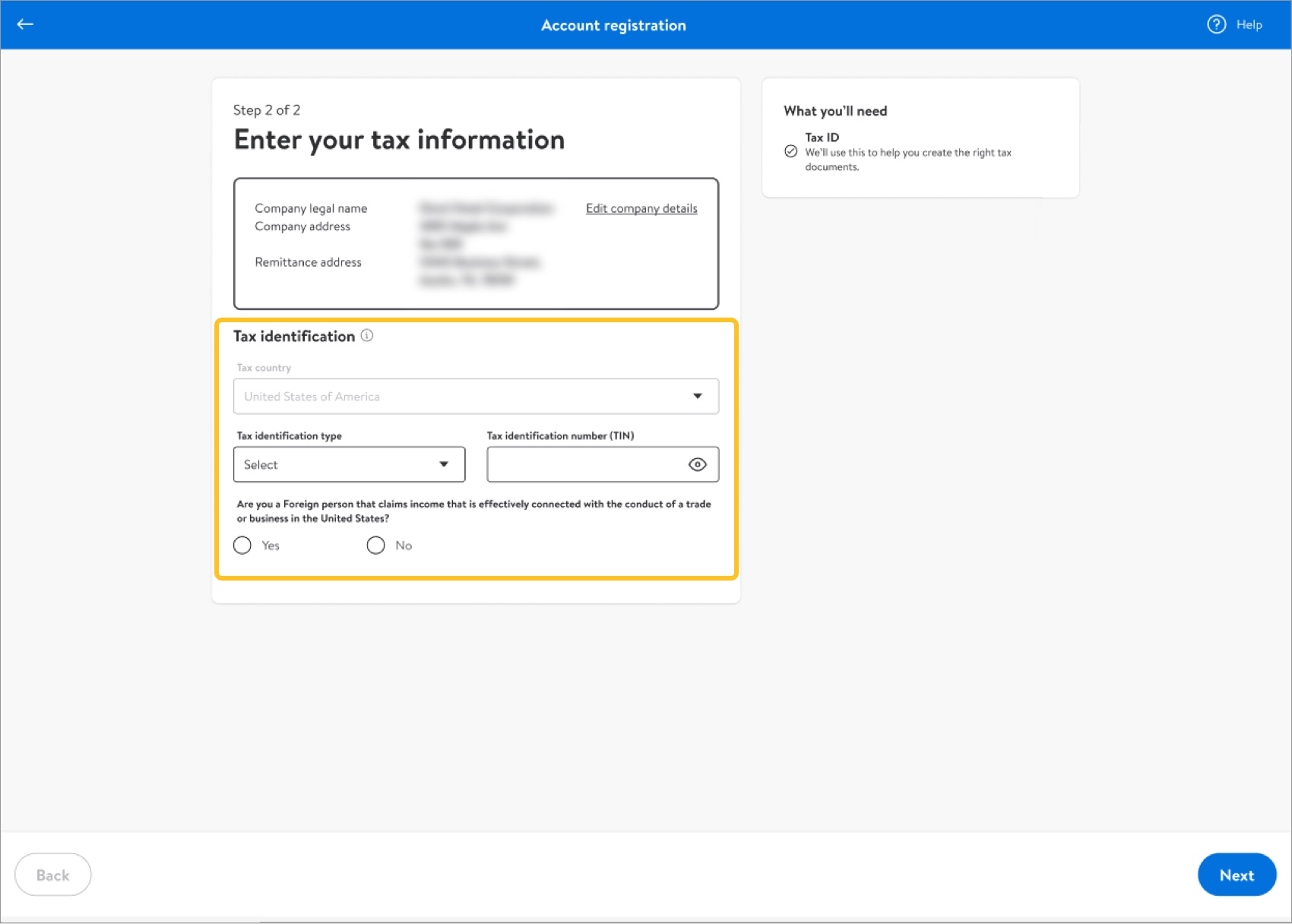

- Provide your tax identification.The options for Tax identification type are Social security number or Federal tax ID.

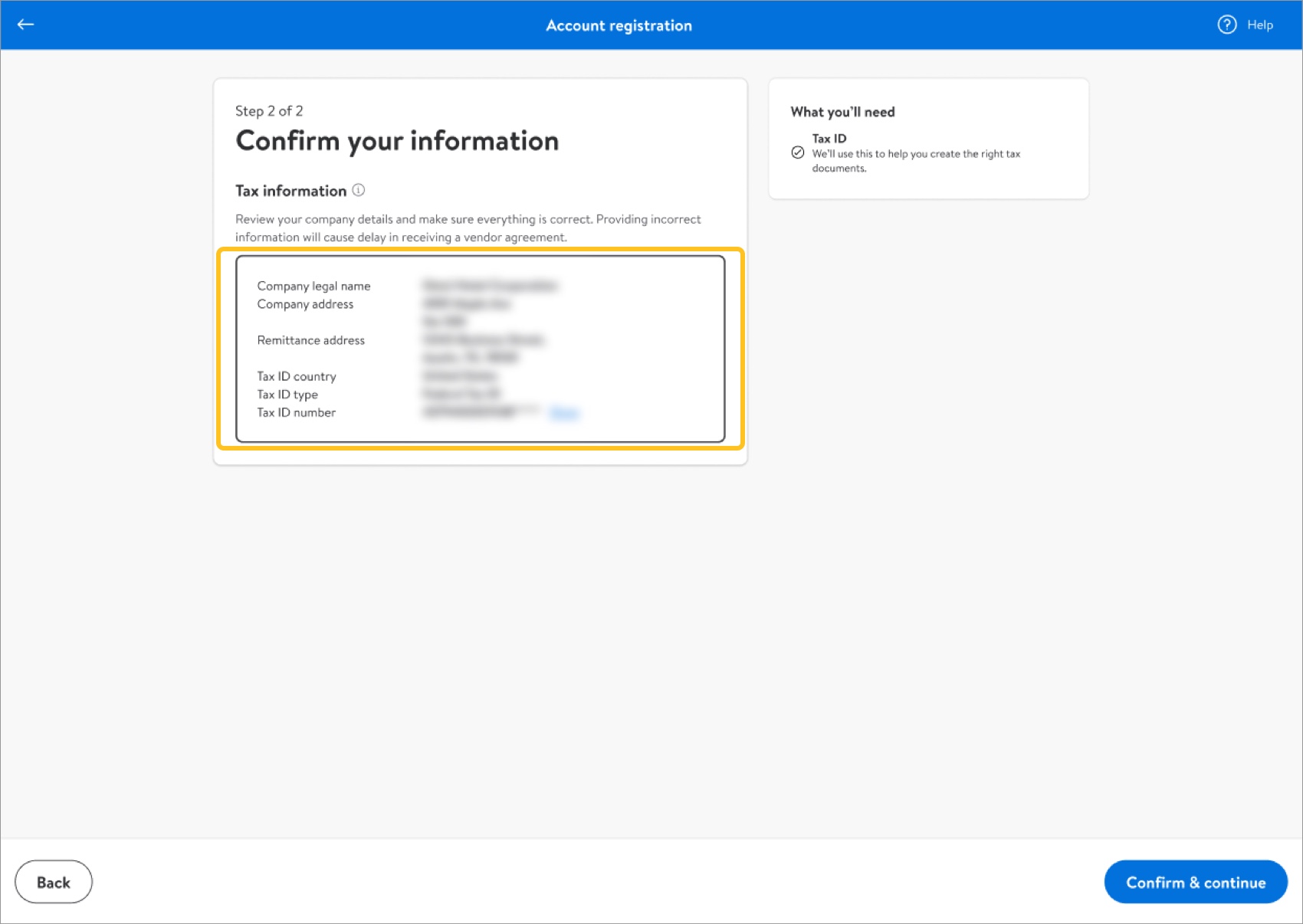

- Review your tax identification. If it's correct, click Confirm & continue.If it's incorrect, click Back to make edits.

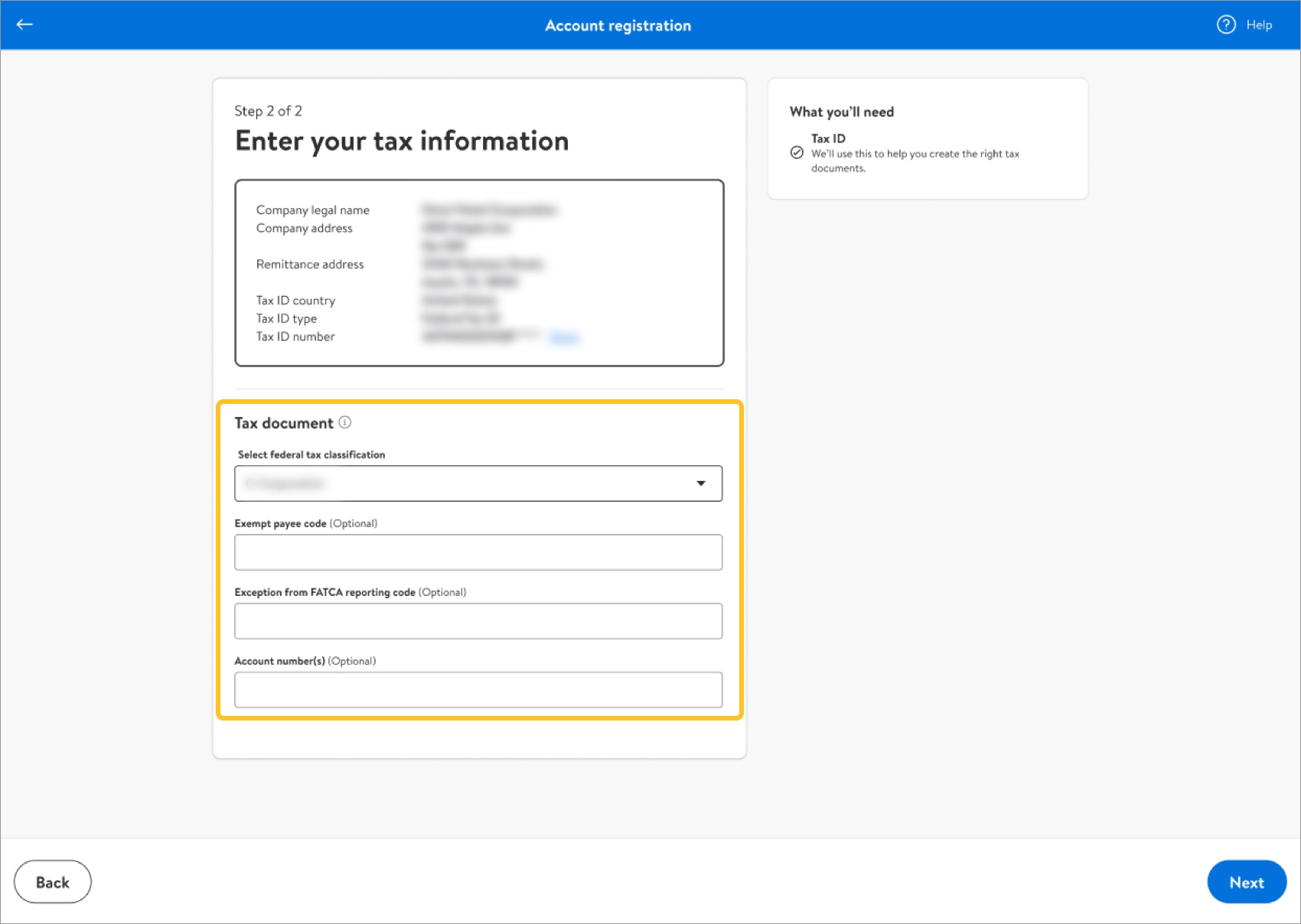

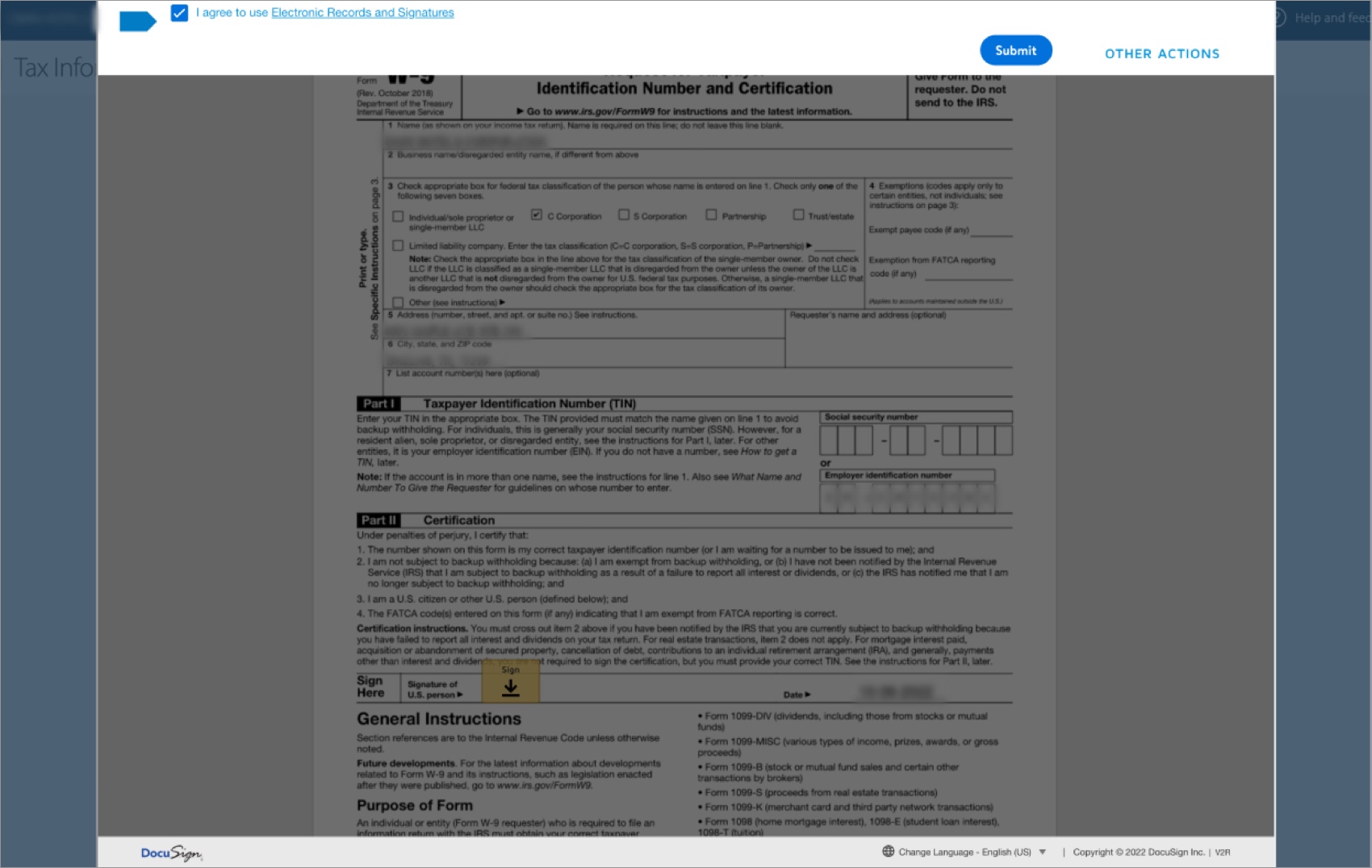

- Provide your tax document. Then, click Next.The options for federal tax classification are Individual/sole proprietor or single-member LLC, C corporation, S corporation, Partnership, Trust/estate, Limited liability company, or Other.

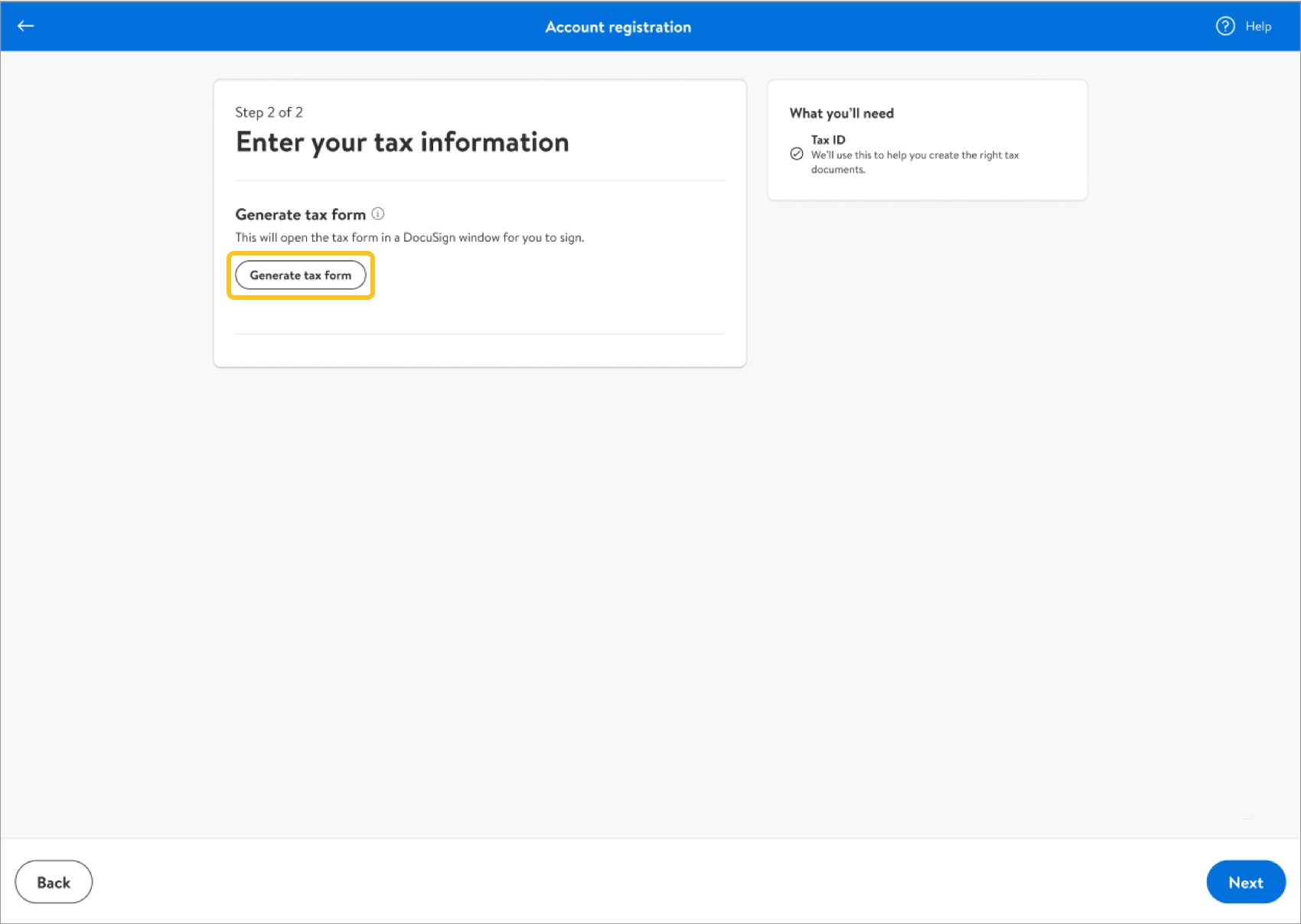

- Click Generate tax form.

- Sign your W-9 tax form and click Submit.

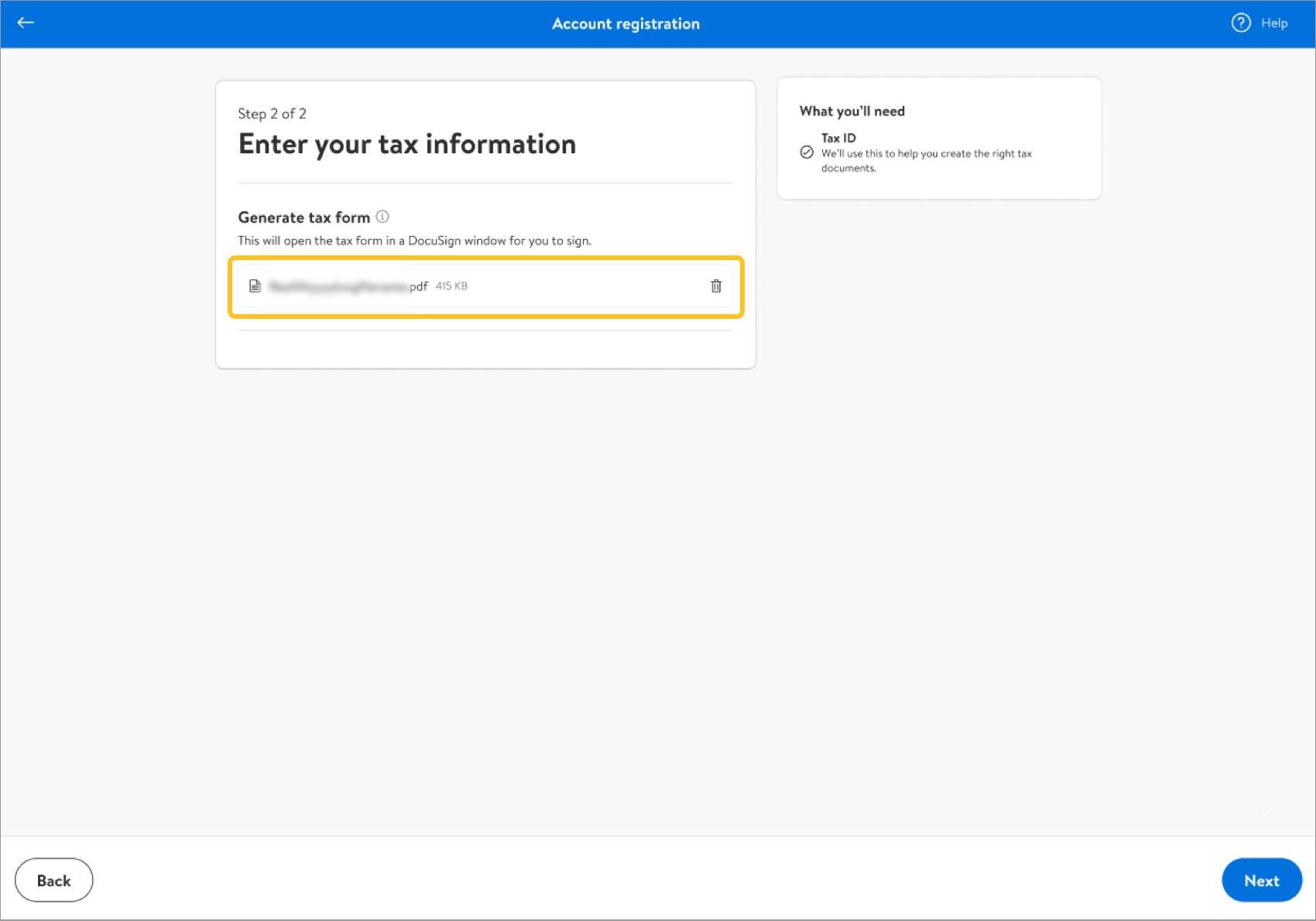

- Confirm your tax form (PDF) appears. Click Next.

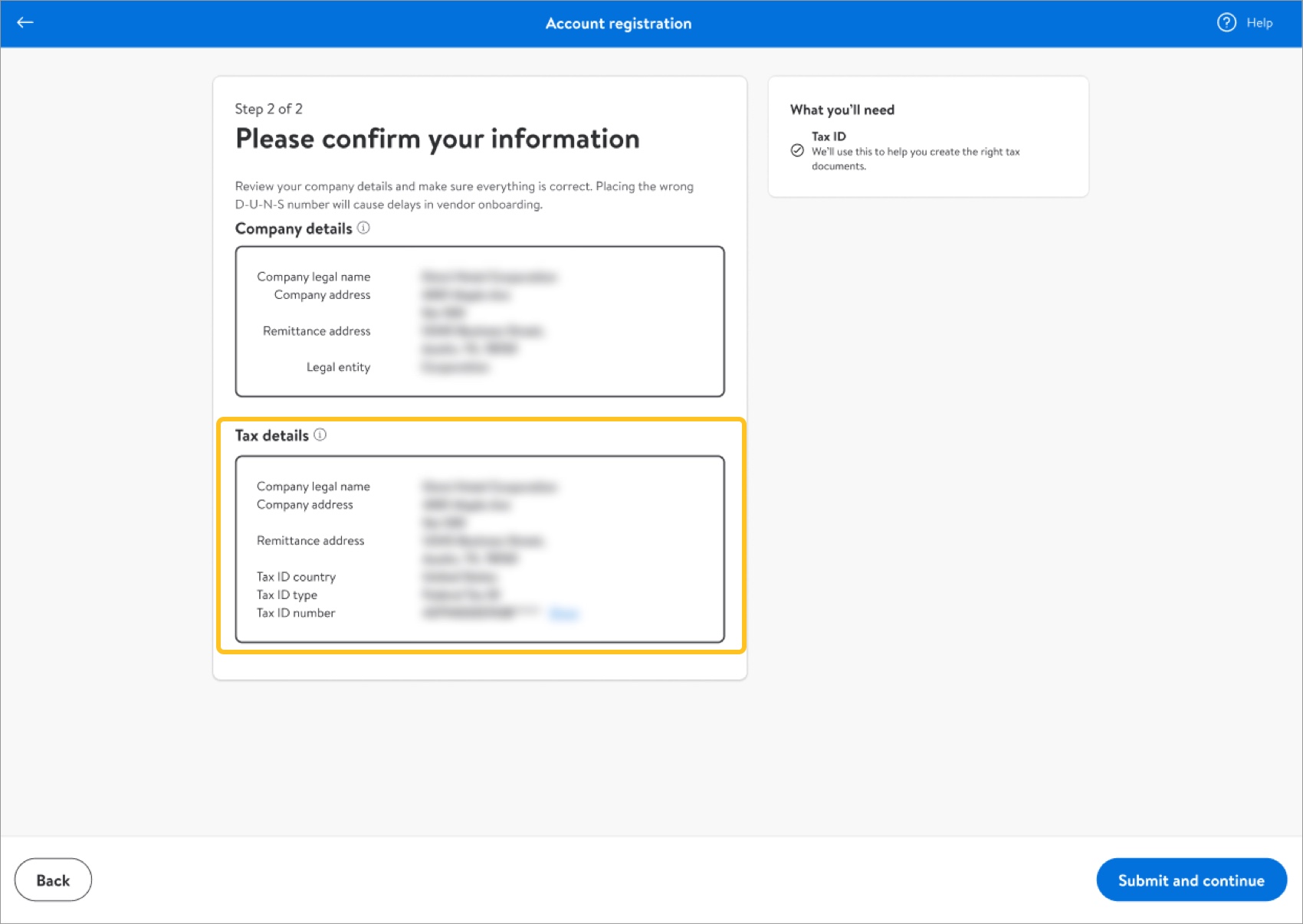

- Review your tax details. If they are correct, click Submit and continue.If they're incorrect, click Back to make edits.

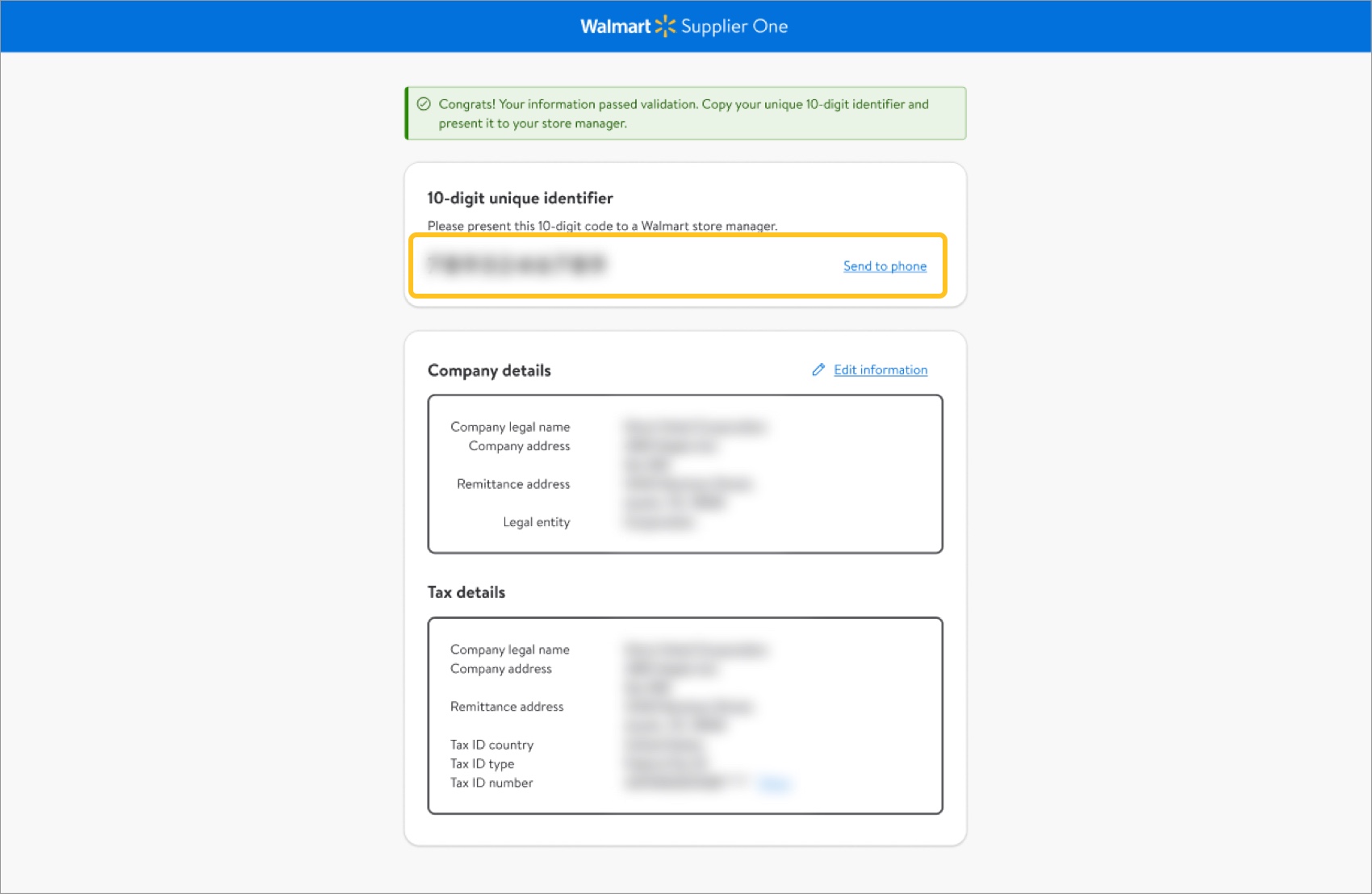

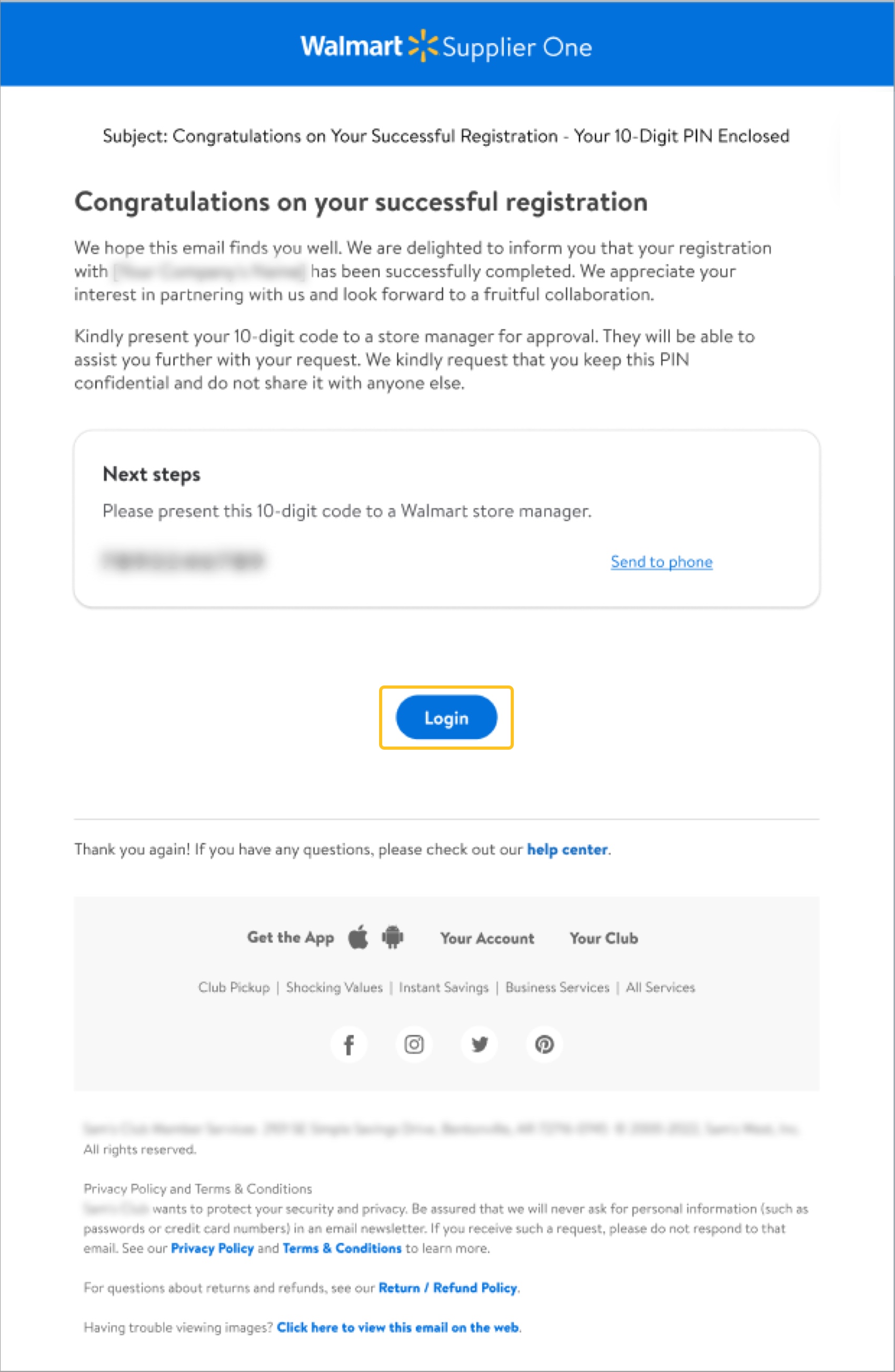

- Upon successful submission, you will receive a 10-digit code that needs to be provided to the Walmart Store Manager for future transactions.

- The 10-digit code will also be emailed to you. Click Login to view your supplier profile.

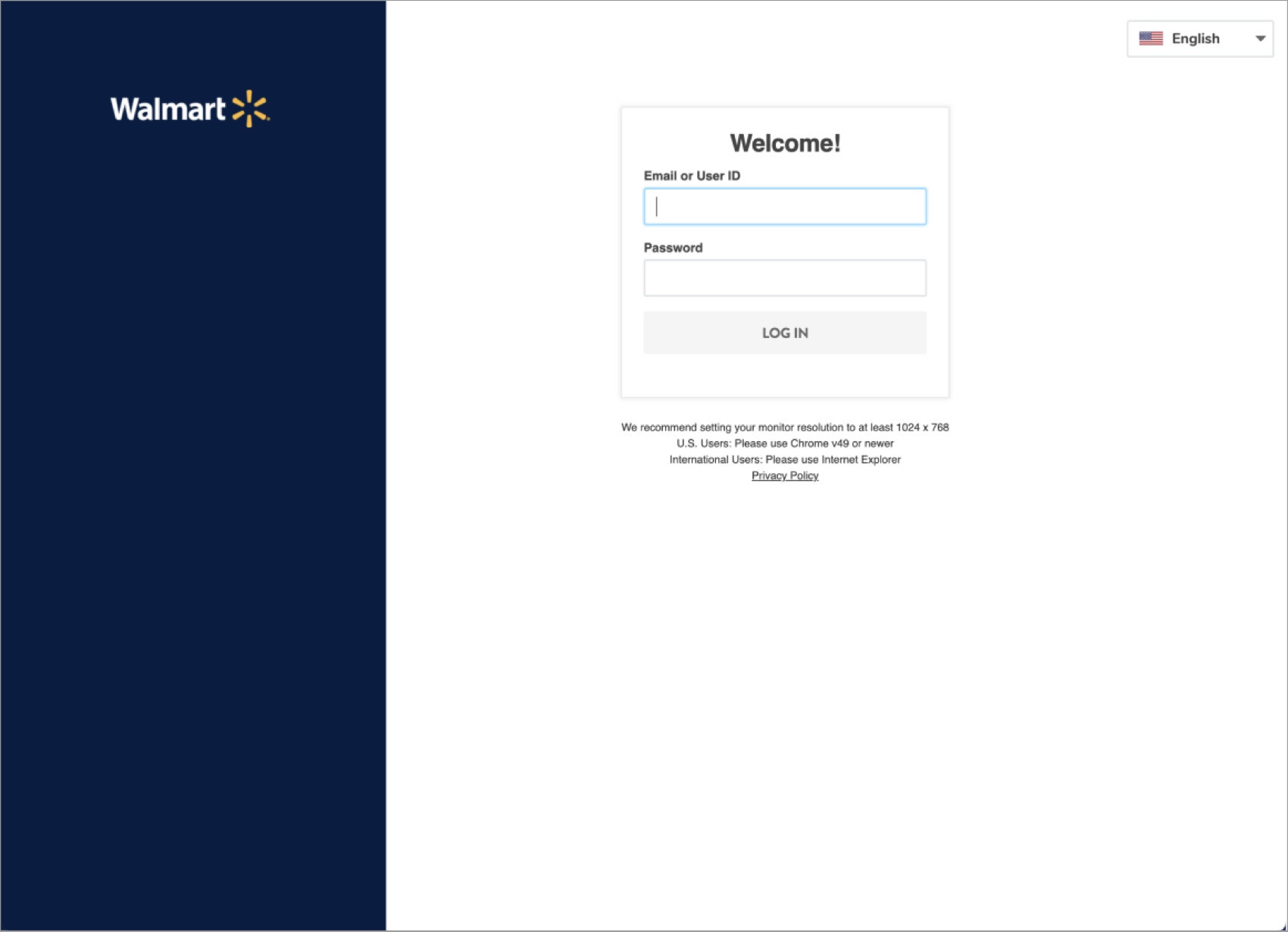

- Log in to https://walmart.com/w9 with your Retail Link User ID (email address) and password.

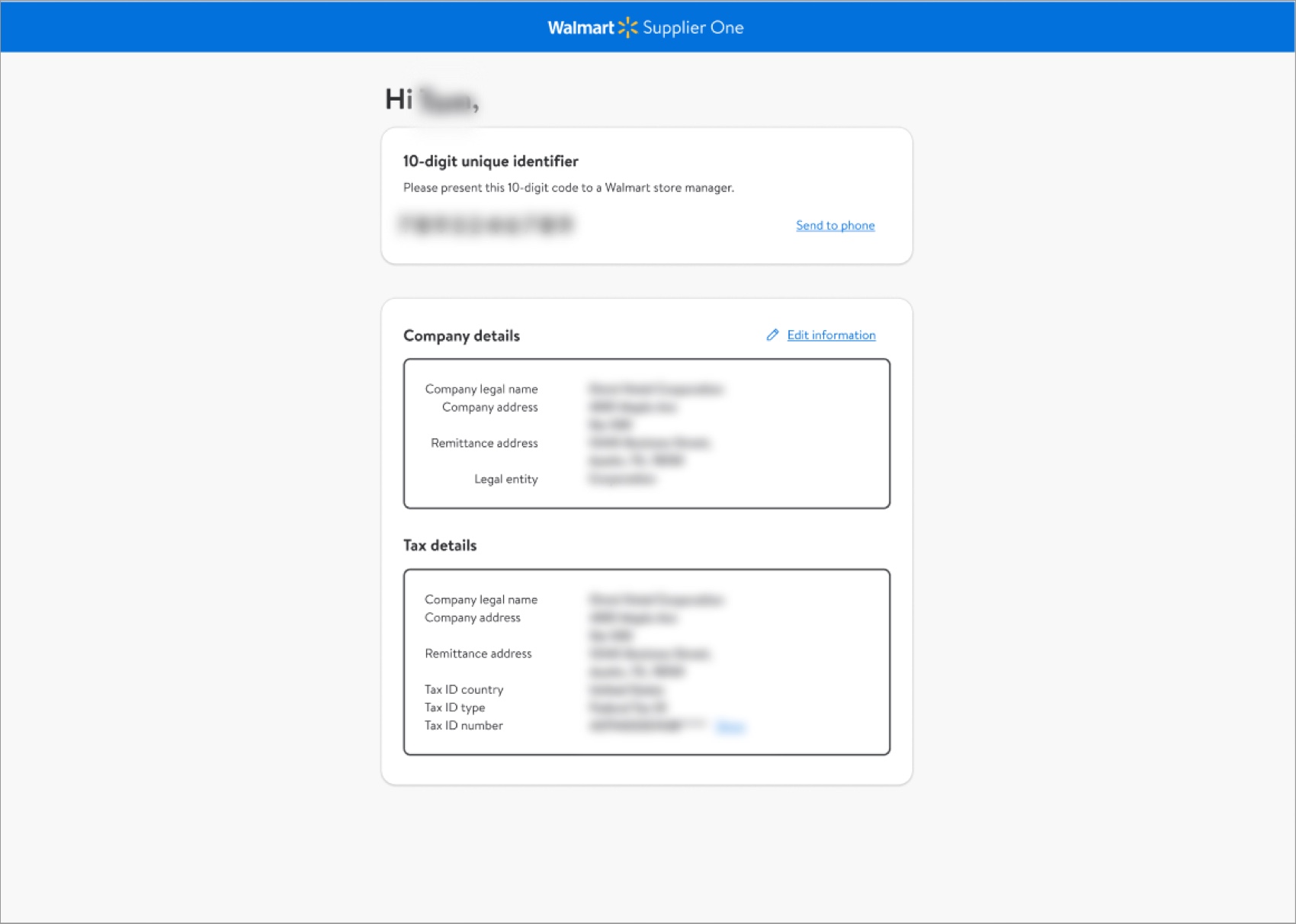

- Your supplier profile will look like this example. If your company details or tax details change at any time, click Edit information to ensure your profile is up to date.

Need Support?

The most direct way to resolve onboarding questions or issues is to contact the Retail Link Help Desk at 479-273-8888 or toll-free 888-499-6377. Refer to Supplier Onboarding: Support (GFR) for information that will help expedite your Help Desk experience. You can also click Help within Supplier One to get assistance from the Supplier One chatbot, manage tickets, and search articles.